What is a 1031 exchange and how can it benefit you?

Simply put, a 1031 Exchange is a process that allows wise investors to defer capital gains taxes on the sale of investment real estate. With the 1031 Exchange process, investors can increase their potential cash flow, invest into markets in other areas/states, and even diversify or consolidate their current property.

Benefits:

- Tax deferment: avoiding taxes on Capital Gains upon sale of asset

- Greater Income potential: We can help customers sell raw land and acquire income-producing property, such as a building with rentable units.

- Diversifying your investments: The 1031 process allows you to exchange into different types of investment real estate such as land to residential, or residential to commercial.

- Moving Markets/Areas: Northgate can help you exchange your current investment property into a property in a different state.

- Consolidation: Owners of multiple properties can exchange them for one property that is potentially easier to manage and even more profitable.

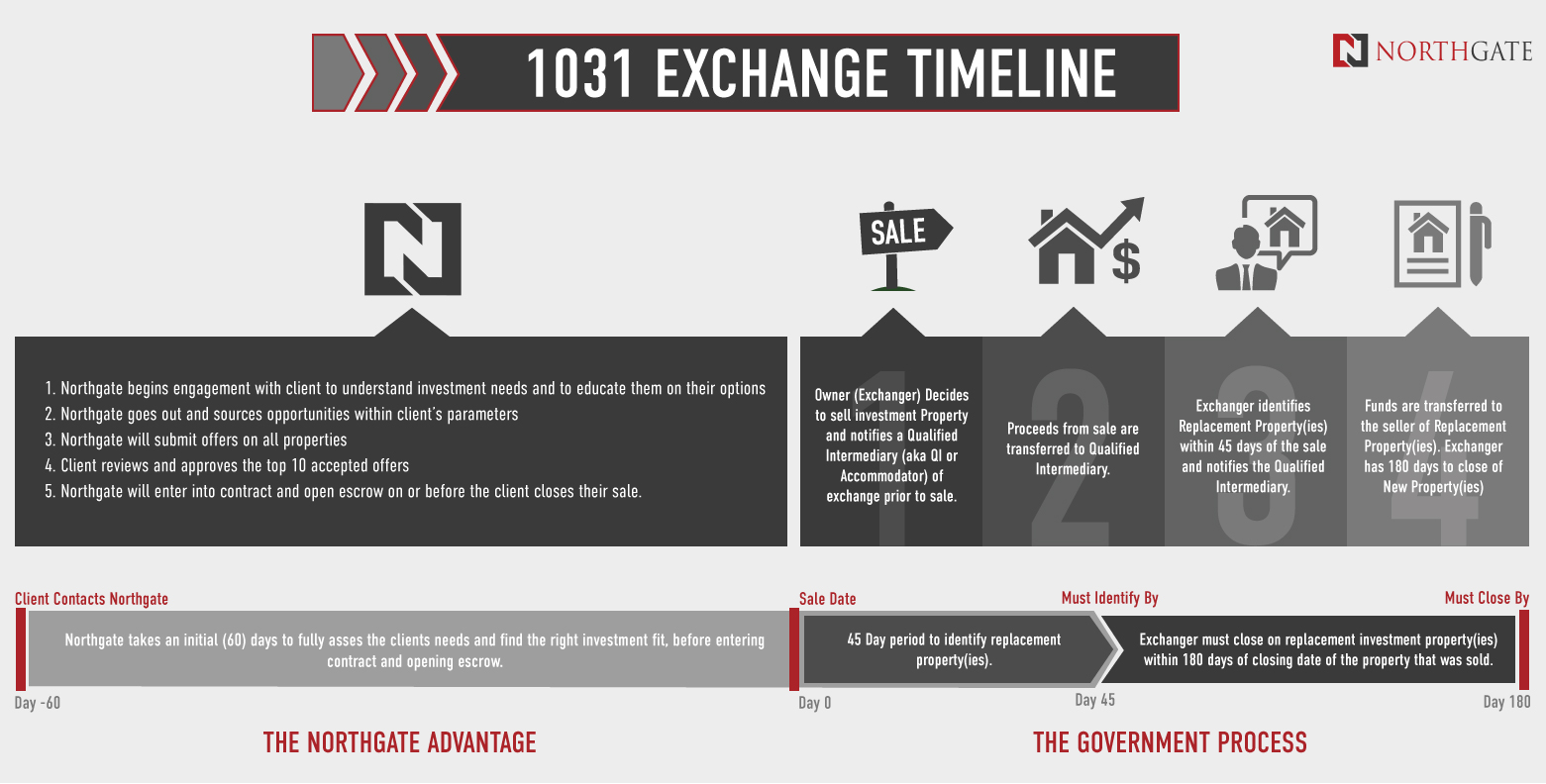

The Northgate 1031 Exchange Advantage.

At Northgate Commercial, we engage with clients prior to close of escrow on the property they are wanting to exchange. Within a 90-day period before entering the official 1031 Exchange period, we meet with our clients to get a better understanding of their investment needs and educate them on their options. This process is designed to give the client more than enough time to find an investment that fits their needs, leaving no questions at the end of the 1031 Exchange Process.

- Within this 90-day period we will go out and source opportunities within a client’s specified parameters, coast-to-coast.

- Northgate will submit offers on all qualified properties.

- The client and Northgate together, will review and approve the top 10 accepted offers.

- Northgate will then enter contract and open escrow on or before the clients closes the sale of their property, they wish to defer capital gains on.

- The client will now have a best idea of the property they want to exchange for, while officially entering the 45-day period mandated by the government. This helps take the stress off the client wanting to take their time to find the right investment property for them.